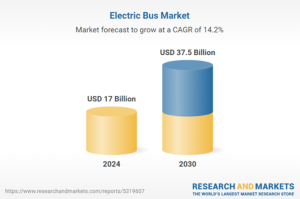

The global electric bus market is moving at an accelerated pace, projected to grow from USD 17.0 billion in 2024 to USD 37.5 billion by 2030, reflecting a compound annual growth rate (CAGR) of 14.2%. This surge is driven by a combination of factors, including stringent environmental regulations, technological advancements in battery systems, and substantial investments in charging infrastructure. Leading this transformative shift in public transport are major manufacturers such as China’s BYD Company Ltd., Higer Bus Company Ltd. (a partner of Chariot Motors AD), Yutong Co., Ltd., the Netherlands’ VDL Groep, Sweden’s AB Volvo, and Spain’s CAF (Solaris Bus & Coach sp. z o.o.), among others.

Market Dynamics and Growth Drivers

The growing interest in electric buses stems primarily from global initiatives aimed at reducing carbon emissions and promoting sustainable urban mobility. Government subsidies and incentives for zero-emission vehicles play a critical role in accelerating adoption. Furthermore, advancements in battery technology are improving the range and performance of electric buses, making them increasingly suitable for both urban and intercity routes. The integration of electric buses into public transport fleets is further facilitated by the development of robust charging infrastructure, enabling seamless operations and reduced downtime.

Segment Analysis: Bus Length and Range

In terms of vehicle length, the 9 to 14-meter segment is expected to capture the largest market share after 2024. These medium-sized buses, capable of carrying between 40 and 80 passengers, offer a strong balance between capacity and maneuverability, making them ideal for urban environments. Manufacturers are focusing on this segment to meet the rising demand for efficient urban transport solutions. For instance, Higer’s 8.8-meter and 12-meter Azure battery electric buses fall into this category and are specifically designed for city use.

When it comes to range, buses capable of traveling over 320 km on a single charge are expected to be the fastest-growing segment through 2030. The increasing need for intercity and long-distance travel is driving manufacturers to develop extended-range models. North America is likely to lead this segment, supported by its well-developed charging infrastructure that enables long-haul electric bus operations.

Regional Outlook

In the Asia-Pacific region, China and India are at the forefront of the global electric bus market. China’s aggressive policies and heavy investments in electric mobility have significantly advanced its domestic market. India is also making strong progress through government-led initiatives aimed at electrifying public transport as a measure to combat urban pollution.

In Europe, countries such as the Netherlands, Sweden, and Spain are seeing increased adoption of electric buses, supported by strict environmental regulations and commitments to reduce greenhouse gas emissions. Manufacturers like VDL Groep and AB Volvo are contributing actively to the European market with innovative offerings.

In Bulgaria, the introduction of electric buses is progressing at a moderate yet steady pace, backed by national and EU-funded programs promoting sustainable transport and the modernization of urban fleets. Key drivers of this transition include projects financed through operational programs such as “Environment” and “Regions in Growth,” as well as funding from the Recovery and Resilience Plan.

Major cities like Sofia, Plovdiv, and Burgas are already integrating electric buses into their public transportation systems, with Sofia’s public transport operator actively expanding its electric fleet with EU support.

North America is experiencing steady growth in electric bus deployment, fueled by federal and state-level incentives as well as increased public awareness of environmental conservation. The region is focusing on building comprehensive charging networks that support the integration of electric buses into public transport systems.

Technological Innovation and Advancement

Battery technology evolution is at the core of market growth. Improvements in energy density, charging speed, and battery life are enhancing the performance and reliability of electric buses. Manufacturers are investing heavily in research and development to produce models with extended range and faster charging capabilities.

Additionally, the integration of smart technologies such as telematics and fleet management systems is optimizing electric bus operations. These technologies enable real-time monitoring, predictive maintenance, and efficient route planning, helping to reduce operational costs and improve service reliability.

Challenges and Opportunities

Despite the positive outlook, the electric bus market faces several challenges, including high upfront costs, limited charging infrastructure in some areas, and concerns about battery recycling and disposal. Overcoming these barriers will require coordinated efforts from governments, manufacturers, and other stakeholders to develop sustainable solutions and supportive policies.

At the same time, the market presents significant opportunities, particularly in developing countries where urbanization and environmental concerns are driving investments in clean public transport. Additionally, as battery technology advances and economies of scale are achieved, costs are expected to decline, making electric buses more accessible to a broader range of operators.

Conclusion

The global electric bus market is on track for substantial growth, driven by environmental imperatives, technological innovation, and supportive policies. As demand for sustainable urban transport continues to rise worldwide, electric buses are set to play a central role in the future of public mobility. Manufacturers and stakeholders must continue to collaborate and innovate to overcome challenges and capitalize on the opportunities of this dynamic market.

Source: Research and Markets